Royal Bank of Canada provides Royal Credit Line to the users. Before getting details about it, readers should first understand the meaning of a Line of Credit. So, a line of credit is a preset limit to borrowings which is offered by banks and other financial institutions to personal as well as business customers. Interested individuals can use a www.rbcroyalbank.com Credit Line at any time until they reach the limit.

The bank or financial institution checks the creditworthiness of the borrower to see the Line of Credit limit. Please note that once the money is repaid, it can be borrowed again. Borrowers will be able to access funds from the LOC as long as they do not spend more than the maximum amount mentioned in the agreement.

What is the Line of Credit?

Customers will have to qualify to get approval for the Line of Credit. Please note that all LOCs include a set amount which can be borrowed as needed, paid back and then borrowed again. Individuals get the chance to choose between a Secured and Unsecured Line of Credit.

Royal Bank of Canada is providing the whole application process online to apply for the Royal Credit Line. The officials have claimed officially that beneficiaries could save on interest costs and consolidate their higher-interest debt through LOC.

Key Features of www.rbcroyalbank.com Credit Line

After learning basic details about the Credit Line, it is time to learn the key features offered by the Royal Bank of Canada under the Royal Credit Line:

- Everyday low rate: Beneficiaries will be able to save thousands of dollars a year in interest. Please note that rates are typically lower than those offered by credit cards.

- No annual fee: Individuals will not have to pay any extra fee to withdraw funds and the banks do not charge over-limit fees on Royal Credit Line accounts.

- 24/7 access: Borrowers can easily withdraw funds at the ATM, write cheques from their account, or transfer money through RBC Online Banking.

- Additional Features & Benefits: Borrowers can decrease their credit limit and close their accounts (if needed) through RBC Online Banking.

- Reuse available credit: Applicants will not have to apply again for the line of credit after paying down the balance.

- Flexible payment options: Borrowers can make just the minimum payment, or pay more to reduce their balance. They can also make changes to their payment account, payment amount, payment frequency or payment due date through RBC Online Banking whenever they want.

- Optional: The optional benefits like LoanProtector life and disability or critical illness insurance are offered to protect beneficiaries and their families.

- Available Credit Alerts: Beneficiaries will automatically get an alert if their available credit falls below $100. Their alert limit can be customized to meet their needs and preferences, helping borrower stay connected to their money.

Types of RBC Line of Credit

Once the beneficiaries apply for the Royal Bank of Canada Line of Credit, they will get a chance to choose between Secured and Unsecured Lines of Credit. Let’s understand the difference between them:

| Secured Line of Credit | Unsecured Line of Credit |

| The interest rate varies and will change according to the RBC Prime Rate. | Credit limits are available from $5,000, with no collateral required. |

| Limits are available from $5,000 to as much as 65% of the value of the home less any prior outstanding mortgages. Or else, it is available up to a maximum of 65% of the value of the home. | Get a competitive interest rate, depending on their credit history and financial standing. |

| The interest rate varies and will change according to the RBC Prime Rate. | The interest rate varies and will change according to the RBC Prime Rate. |

How to apply for the Royal Credit Line?

The following are the steps which can be used to apply for the Royal Credit Line:

- Go to the official portal of the Royal Bank of Canada i.e., https://www.rbcroyalbank.com/

- Now, find and go to the Loans option on the home page.

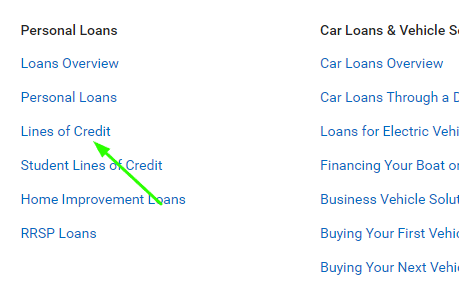

- After that, go to the Personal Loans section and click the Line of Credit option.

- A new page will open where you must read all the details and click the Sign In button.

- After that, provide essential details and get access to the LOC Application Form.

- Provide all details on the application form carefully and move towards the next stage.

- Upload the necessary documents (If Asked).

- Submit the application form to complete the process.

Frequently Asked Questions

How to get more information about the www.rbcroyalbank.com Credit Line?

Individuals can get more information by talking with a Credit Specialist through this number: 1-833-976-4587 or one can visit the nearest branch.

Where will I get the Royal Line of Credit Application Form?

The application form can be accessed by signing into the Royal Bank of Canada portal.