The USAA i.e., United Services Automobile Association is an American financial services company that provides insurance and banking products exclusively to military members, veterans and their families. Interested individuals can get benefits of the USAA Personal Loan which provides instant funds when needed. The company do not ask for application or early repayment fees.

USAA Bank Personal Loan is one of the best alternatives to using a higher-interest credit card. Interested applicants who want to get benefits of the USAA $1000 to $100K Personal Loan can apply for it. The loan application form is available on the official website of the United Services Automobile Association. Read the following article thoroughly and get information regarding the eligibility criteria, application process and more.

USAA Personal Loan

The company is offering users with a personal loan between $1000 to $100,000 with flexible terms. Once, a candidate applies for the personal loan their details get saved with the officials. In the future, if a person refinances a current USAA Personal Loan, they replace their loan with a new one.

So, applicants will be able to get a better rate, get additional cags, reduce the payments and change the payoff time accordingly. Once the application gets approved, the officials will transfer the loan amount within two business to the account of the beneficiaries.

Uses of www.usaa.com Personal Loan

The personal loan has many uses. it depends on the requirements of the users and how they will spend the money. The following are some of the main uses of USAA Personal Loan:

- Managing Debts: With the help of the personal loan, applicants will be able to manage their bills more easily. All the high-interest loans and credit cards can be paid off through the personal loan and they will be able to save the interest amount.

- Home Improvements: Nowadays, remodelling and renovating a home can be very expensive. Interested ones can take out a USAA Personal Loan to cover the expenses of quickly upgrading and repairing the house.

- Planned and Unplanned Expenses: A sudden emergency occurs which gives the person an expensive medical bill. Don’t worry, individuals can cover planned and unplanned expenses like medical bills through personal loans.

How to apply for the USAA Personal Loan?

Individuals will have to follow a certain process to apply for the USAA Personal Loan. Or else, they might face issues in the middle of the process. The following is the step-by-step process to submit the www.usaa.com Personal Loan Application Form:

- First of all, visit the official website of the United Services Automobile Association i.e., https://www.usaa.com/

- Scroll down the page and go to the section where you will see a caption “Here are some other products and services we offer”

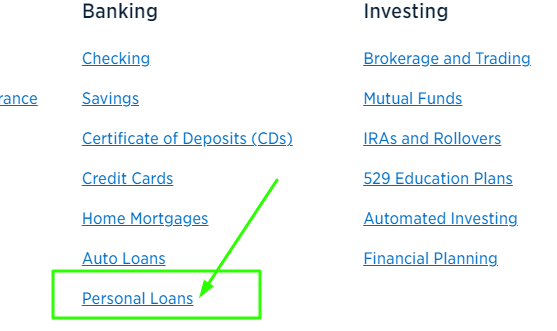

- Under that, go to the Banking section and click the Personal Loans option.

- After clicking the option a new page will appear on the respective device.

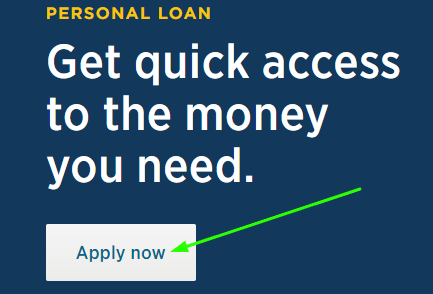

- Now, learn details about the personal loan and click the Apply Now link.

- Log into the portal by providing the necessary and get access to the application form.

- Start entering the required details on the application form carefully and move towards the next stage.

- Afterwards, upload the necessary documents and recheck the whole application form.

- Finally, click the submit button and complete the application submission process.

Required Documents to apply for the USAA $1000 to $100K Personal Loan

While applying for a personal loan, the company ask for several documents to ensure that the details mentioned by the applicants in the application form are correct. The following is the list of documents which might be needed while applying for the loan:

- Proof of income (pay stubs, W-2 forms)

- Proof of address

- Bank statements

- List of debts

- Employment status (if self-employed: bank statements, 1099 forms, income tax returns)

- List of expenses

- Official identification, sometimes two forms (driver’s license, passport, state-issued ID, certificate of citizenship, birth certificate, military ID, Social Security card)

Pay off Your Debt Faster with a $500-$60,000 Loan

Frequently Asked Questions

What are the required eligibility criteria for USAA $1000 to $100K Personal Loan?

The eligibility depends on the amount. The officials usually check minimum credit score, specific income threshold, minimum number of years of credit history, etc.

What is the interest rate on USAA Personal Loan?

The company has stated officially that they provide USAA Personal Loan with rates as low as 10.19% APR. Use the USAA Personal loan calculator to know the interest rate which will be charged on your loan amount.