Navy Federal Credit Union is offering Auto Loans to its users. Individuals interested in applying for car loans must check out Navy Federal Auto Loan 2024. The company is offering auto loans at very low interest rates.

According to the officials, they are offering loans to individuals to buy new or used cards and even refinance card loans. Navy Federal Auto Loan Rates can be as low as 4.09% APR for New Vehicles. Individuals who want to get a loan and are interested in applying should read the following article. It includes details like the eligibility criteria, application process and more.

Navy Federal Auto Loan 2024

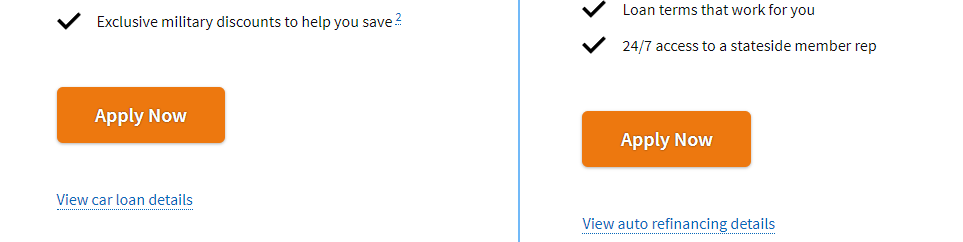

The company is offering two types of www.navyfederal.org Auto Loans to the users i.e., New and Used Car Loans and Refinance Car Loans. Some of the benefits of the New and Users Card Loans are most applications get evaluated in seconds, preapprovals are good for loans for up to 90 days and available of exclusive military discounts.

Some of the benefits of Refinance Car Loans are flexibility of loan terms that work for users, stateside member rep availability for up to 24/7 and the opportunity to get $200 when a person refinances their auto loan from another lender. The whole loan application process for the Navy Federal Auto Loan will be conducted online which means anyone can apply for the loan from anywhere.

www.navyfederal.org Auto Loan Rates

Checking the loan rates will help readers understand whether the loan is suitable for them or not. Along with it, individuals can also compare the interest rates offered by other leading companies. The following is the table showing loan rates:

| Loan Type | Up to 36 mos. APR as low as | 37-60 mos. APR as low as | 61-72 mos. APR as low as | 73-84 mos. APR as low as | 85-96 mos. APR as low as |

| New Vehicle | 4.09% | 4.49% | 4.79% | 6.69% | 7.59% |

| Used Vehicle | 4.99% | 5.49% | 5.59% | N/A | N/A |

$35000 Credit Card Consolidation Loans, Without any Prepayment Penalty

Lamina Personal Loan 2024 – Borrow $300 up to $1500 in 1 hour, No credit checks

OMG! $300-1000 Personal Loans without credit check, money in 10 minutes

How to apply for the Navy Federal Auto Loan 2024?

Readers who have decided that they want to apply for the loan should go through this section to understand the loan application submission process in detail. The following is the step-by-step process to submit the Navy Federal Auto Loan Application Form:

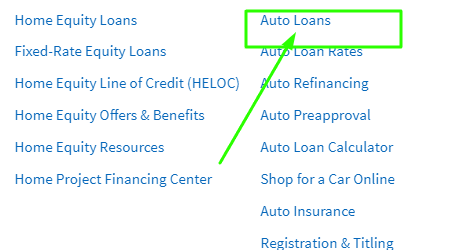

- Start the process by searching the website of the Navy Federal Credit Union using this link: https://www.navyfederal.org/

- Seconds after searching the link, the website’s home page will open on the screen.

- Afterwards, you must find and click the Loans option and a menu holding various links will appear on the screen.

- Find the Auto Loans option and click once to open a new page on the respective device.

- Read all the essential information about it and choose between New and Used Car Loans and Refinance Car Loans.

- Afterwards, tap the Apply Now available below the respective loan to open the application form.

- Start entering the details on the application form carefully and move towards the next stage.

- Attach the necessary documents to the application form and go through the whole form.

- Finally, submit the form and the application submission process will be completed.

Required Documents and Information to apply for the Navy Federal Car Loan

The following section includes information regarding the documents and information which is needed to apply for the Navy Federal Auto Loan. Or else, individuals will not be able to apply for the loan. The following are the necessary documents and information to apply for the loan:

| Any vehicle trade-in information (title or loan information, registration, etc.) |

| Current housing, employment and income information |

| Contact information (phone number and email) |

| The amount expected to finance (including vehicle purchase price, taxes, tags, title and warranty, minus any down payment) |

| Length (term) of the desired loan |

| Vehicle Information: |

| the 17-character vehicle identification number (VIN) |

| the state where you’ll register the vehicle |

| the exact mileage reading |

| the dealer or seller’s name |

Good News! $1500 Payday Loan even with Bad Credit, Apply Now

Listen Guys! Get Hassle Free $1500 payday loan in minutes, Paperless Process

Frequently Asked Questions

What will my www.navyfederal.org Auto Loan monthly payment be?

The monthly payment will be determined by various factors such as the loan amount, term and interest rate. Individuals will be able to estimate what their monthly payments could be with the help of the official Auto Loan Calculator.

What is the car eligible to apply for the Navy Federal Auto Loan?

New Vehicles: New and late model used vehicles (2023 and newer model years) with 30,000 or fewer miles.

Used Vehicles: 2022 and older model years or any model year with more than 30,000 miles. Vehicles 20 years or older (based on model year) are considered classic or antique and they are subject to Other Eligible Vehicle rates.