BDC Small Business Loan Canada: BDC is a bank for Canadian entrepreneurs. The company has been working with new as well as well-known entrepreneurs for more than 75 years. The company supports the entrepreneurs financially. Readers interested in getting information regarding the BDC Small Business Loan Canada have landed on the right page.

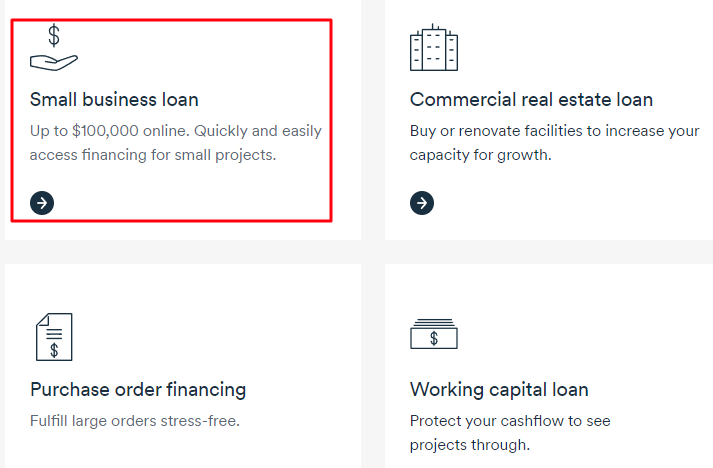

The company understands the challenges faced by entrepreneurs along with their needs. Therefore, this company gives $100K Small Business Loans which requires no application fees. The claiming process is 100% online which makes the process way easier than other loan-providing companies. Scroll down the page and get information related to the business loan, eligibility conditions and more.

BDC Small Business Loan Canada

Sometimes, people have to act fast to get opportunities. The company has designed the Business Development Bank of Canada Small Business Loan to help eligible individuals quickly and provide easy accessibility to funds which candidates with flexible terms need. The authority has removed the application fee for the convenience of candidates.

The whole application process for the loan is conducted on the official website of Client Space. Beneficiaries use the online platform to offer BDC clients personalized and protected 24/7 access to the account. Individuals will have to register and log into the portal to use services like applying for the loan tracking the BDC Small Business Loan status and more.

Benefits of www.bdc.ca Small Business Loan

The following section will provide essential information regarding the benefits which is offered by companies under the Small Business Loan. Below are the key benefits of a BDC Small Business Loan:

- Unparalleled Flexibility: The authority allows the beneficiaries to postpone the principal payments for the first six months. Along with this, beneficiaries can repay the loan according to their capability over five years.

- Affordable and Convenient: The company offers the benefits of loans at an affordable rate. No application fees need to be paid by beneficiaries. No penalties for early or lump-sum payments will be charged by the company.

- Peace of mind: The company does not change their terms and conditions without due cause. So, beneficiaries will not have to worry about sudden changes which will cause the loan-related activities.

Required Eligibility Criteria to get BDC Small Business Loan

After taking a good look at the www.bdc.ca Small Business Loan information, it is time to understand the eligibility criteria which must be fulfilled to get the above-mentioned loan easily. The following are the required eligibility criteria details:

- Beneficiaries could be eligible for the BDC Small Business Loan if they have reached the age of majority required in the respective province or territory in which they reside.

- The business should be based and registered in Canada

- The company must have a good credit history

- The business should be operating and generating revenue for a minimum of 2 years.

OMG! $300-1000 Personal Loans without credit check, money in 10 minutes

Wow! $5,000-$40,000 Loan with interest-free, check eligibility

No Credit Check $1500 No Refusal Payday Loans, Application Approved in 30 Minutes

Business Development Bank of Canada Small Business Loan Uses

In the following section, readers will learn the information on how can the beneficiaries use the offered loan amount. Here are some of the major roles which can be done with the offered amount:

- Supplement cash flow: Beneficiaries can use the offered loan amount to Purchase equipment, software, or hardware. It will save the cash every person needs to complete daily activities.

- Sell online to increase sales: Online selling is one of the best ways to upgrade your business. So, one can use the amount to upgrade the website, purchase inventory, run marketing campaigns and hire a consultant to improve the business.

- Cover expenses: Pay suppliers, landlords and employees with the loan.

How to apply for the BDC Small Business Loan Canada?

Once, all doubts regarding the loan have been cleared, it is time to understand the process which needs to be used by applicants to apply to the BDC Small Business Loan Canada. The following are the steps using which the application process can be completed:

- First of all, search the BDC website using this link: https://www.bdc.ca/

- Secondly, the home page of the website will open on the screen.

- After that, find and click the financing option available at the top of the page.

- After clicking the option, a new page will open on the respective device.

- Now, you must scroll down the page and learn all the important information regarding the loan.

- Afterwards. click the Apply Now option to move forward with the process.

- Provide the email address and tap the start button.

- After that, Client Space will open where you must provide the login credentials to open the dashboard. Whereas new users will first have to complete the registration process.

- Now, click the Small Business Loan option and start entering details on the application form.

- Once, the details are filled in, upload the necessary documents.

- Go through the whole application and submit it to complete the loan application process.

Frequently Asked Questions

What is the interest rate on BDC Small Business Loan?

The company calculates the amount of interest rate on the small business loan as follows:

Current floating base rate + variance based on applicant’s personal and business information = interest rate. Therefore, the interest rate amount varies for different candidates.

How much can an individual ask for in a www.bdc.ca Small Business Loan?

Beneficiaries can ask for up to $100,000 for a BDC small business loan. The approved amount will be based on the official analysis of their request.

What is the repayment period for the Business Development Bank of Canada Small Business Loan?

The loans can be repaid over sixty months. Individuals only need to pay the interest portion for the first six months, From the 7th month, the loan needs to be repaid in 60 monthly payments.